ZD 25.14: Trade War 2.0 Wants You

Trade War 2.0 is here for me, you and everyone. See our survival guide.

AI in 2027; the price of vibe coding; M.U.D. makes Texas grow; how innovation strikes randomly; the Trade War 2.0 survival guide with a musical coda to match.

The Distilled Spirit

Present and Future of AI

🔮 AI 2027 (AI Futures Project)

The AI Futures project predicts the future in an entertaining yet disturbing narrative crafted by Scott Alexander. Don’t miss the detailed forecasts that accompany the text if you need more depth.

🏥 Therapy Chatbot Benefits Patients (Dartmouth)

Dartmouth researchers found that AI-powered therapy chatbots improved patient symptoms in a clinical trial. Patients found they could trust the bot as much as a mental health professional.

👩💻 The Price of Vibe Coding (Elevate)

Vibe coding is amazing — but it also makes it very easy to introduce unmaintainable complexity. This is a great reminder that you need to carefully coach the AI and to review the output before deploying.

🎨 OpenAI’s Crimes Against Art (BigTech and AI )

Did Sam Altman’s PR stunt go a bit too far this time?

Policy Corner

🏠 Texas M.U.D. Model (Of All Trades)

Texas Municipal Utility Districts are a construct that is helping Texas keep up with housing demand. Not without warts but worth copying in other places we need more housing.

🗣 Populist Kakistocracy (Richard Hanania's Newsletter)

Kakistocracy — the rule by the least suited — tends to be a feature of many populist movements. This sort of leadership tends to lead to reductions in GDP, slowdowns in growth and self-inflicted wounds.

💧 The Water is a Mirror (Eating Policy)

A simple request to get soldiers bottled water took seven weeks and many legal man hours to check the rules and craft a policy response for $200 worth of water. Complying with the many rules meant to stem waste creates a layer of waste unto itself.

Innovation

🔍 Is Technological Innovation Random? (Byte-Sized History)

The first move down a path can give further development direction. Things like the QWERTY keyboard I am typing this newsletter on are accidents of history rather than marvels of design. Other laws and regulations have shaped industries and public policy writ large.

💾 13 Laws of Software Engineering (Manager.dev)

Thirteen laws of projects and how they apply specifically to software engineering. Good ideas to keep in mind when building things. Never forget Sturgeon’s Law.

Interesting

📦 Silica Gel’s Story (Scope of Work)

It seems like there is a packet of silica gel in every single package I open. Scope of Work tells you a bit about why and how the packet came to be there.

⚽ Marine FC’s Rise (Shorthand)

Marine FC’s magical FA Cup run in 2020 launched a string of promotions. This is almost a FM game in real life.

🌽 Choosing the Right Cooking Oil (Truth Be Told)

8 rules to help you pick the right cooking oil for better flavor and nutrient profiles.

Surviving Trade War 2.0

It has been a wild week in the markets. On 'Liberation Day' the market melted down in response to the updated schedule. I hope your portfolio is on solid ground still. I have been managing investments fairly actively since 2006 so this is not my first market collapse. Here is a collection of thoughts and things to read to survive this mess.

The Great Progression and Generational Bear Markets

America is going through a major transition period. Peter Leyden thinks America is going through a Great Progression — a once every 80-year transition period where the new world is born as the old one fades. Every one of these transitions has forged a stronger, more resilient America — but not without upheaval. These periods were tumultuous. The Civil War and the Roaring 20s are two striking examples of how chaotic the path to progress can be.

In terms of markets, this reminds me that the standard advice — that the market will always rise — might not quite be the case. As Jason Havier points out, unless you were investing before 1982, you've never lived through a true secular bear market — a period where stocks fall and stay down for a decade or more. So here’s the question: are we on the edge of a generational bear market — a long, grinding stretch where fundamentals matter again and easy gains disappear? Will simply betting on the market to go up still work in the decade ahead??

Readings in Tariff Strategy

Most market crises are induced by an outside event of some sort. Those triggered by policy shifts often fall into this category too — typically misguided responses to earlier crises. One of those was the Smoot-Hawley tariffs. Trade War 2.0 looks like economic self-sabotage. Why would someone do this? And what could the results be? Here are a few ideas to consider:

Mitsubishi Financial Group published a detailed, graphical report on the Trade War 2.0. They calculate that we have been seeing some sort of trade war escalation every 3 days since the inauguration. The multi-layered approach — with the baseline 10% for revenue and the rest of the escalated tariffs for negotiating leverage and to achieve policy goals is worth consideration. And don’t miss the charts illustrating how the tariff structure is designed not just as leverage but also as a revenue stream to fund tax cuts — a key part of the administration’s fiscal strategy.

ChinaTalk held an emergency podcast focused on the tariffs and the administration. It is a really enlightened discussion of the different factions within the economics wing of the White House driving these decisions.

Inquiring minds want to know, was this policy AI generated? Moreover, the AEI wonders if the generated formula is applied correctly?

Portfolio Strategy

Holding a stock portfolio through a collapse is tough. But timing the market is hard, and selling every time there's a dip can seriously hurt your long-term gains.

I have invested my way through a few crises. Here are a few strategies I employ during these periods of turmoil:

Stock prices ultimately matter on two days — when you buy and when you sell. Everything in between is immaterial.

Do not panic and sell crown jewels. The big, solid companies that have great businesses will survive. High fliers crash fast, but we are not looking at a collapse of the railways sort of scenario. Companies like Microsoft, Apple, Amazon and Google are still printing money on multiple levels. Keep an eye out for generationally low forward P/E ratios for buying opportunities.

Do not be sentimental. Let go of your speculative bets while you have something left for more bets. You will probably be wrong in a few cases, but you will be more right than wrong in closing the positions. Sell on good news, don’t hold for better news. Ask me how I know.

Small, high EV bets against your overall portfolio are a great way to hedge. Moreover, they cash out right at the best points to buy, when the market is lowest and deals are to be had. I typically hedge using short QQQ puts, since my portfolio leans heavily toward NASDAQ stocks. This strategy allows me to profit when the index drops — the puts gain value as the market falls. It's a useful way to build up cash for reinvesting at market lows. Those puts will shoot up in price if the index falls, like in the last few days, letting you cash when things get worse. Buy options dated nine months to a year out and roll them quarterly and the maintenance price is fairly reasonable, especially if you roll the positions a bit to cash out at intervals.

Dry powder is amazing. Sitting on cash is rarely a bad idea. Just don’t let it burn a hole in your pocket too fast. These things take months not weeks.

I'm not a financial advisor, I am not your financial advisor and this isn't financial advice. This is how I have learned to approach things. You need to look at your situation, understand your goals and risks and act accordingly.

Finally — worry windows are a great idea. Stay strong. This too shall pass.

Musical Coda

The Look

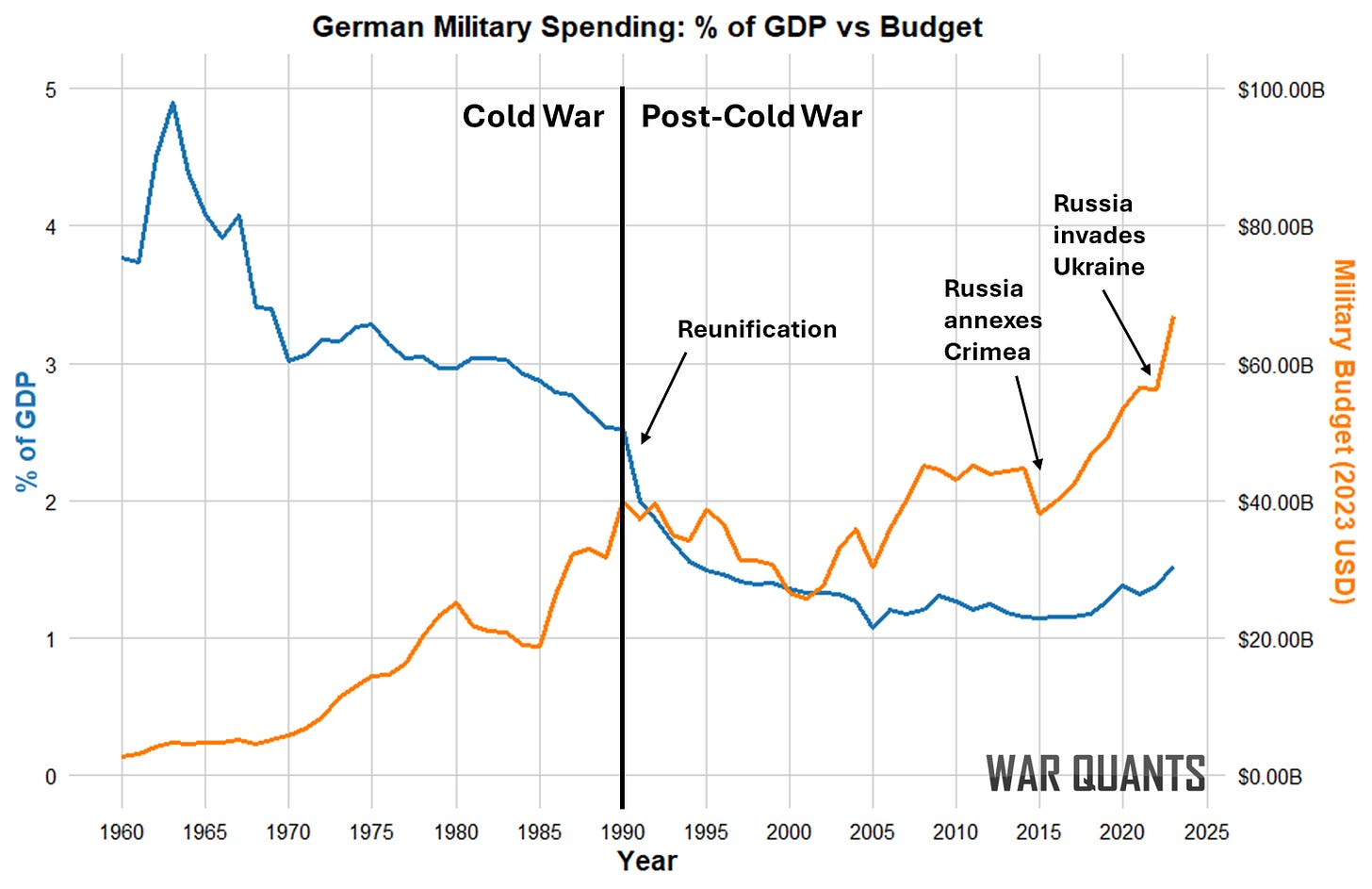

Rearmament on the Rhine via War Quants.

Did you enjoy reading this post? Hit the ♥ button above or below because it helps more people discover great Substacks like this one and it helps train your algorithm to get you more posts you like. Please share here or in your networks to help us grow!